What Development Professionals Should Know about Donor Advised Funds

The popularity of donor-advised funds has skyrocketed over the past decade. But before strategizing to engage DAF holders, development professionals themselves need a foundational understanding of the given vehicle itself.

The entire concept of DAF is not very simple and there are a lot of things to know about, especially regarding strategic development. Read on to know about the giving process, sponsors, and more about a DAF fund.

Why Does DAF Matter?

DAF funds might seem like a new trend. However, in reality, its story began back in 1931 when New York Community Trust established the first donor-advised fund. Since then, DAFs have been building a mutually beneficial relationship for donors and nonprofits.

Since DAFs make the process of giving and taking of claims quick and also reduce the after-tax price of charitable giving, they are preferred by most. Over time the contribution to DAF has grown so much that today it holds over $85 billion in charitable assets. This is almost 7.6% more than it used to be between 2015 and 2016 in the US.

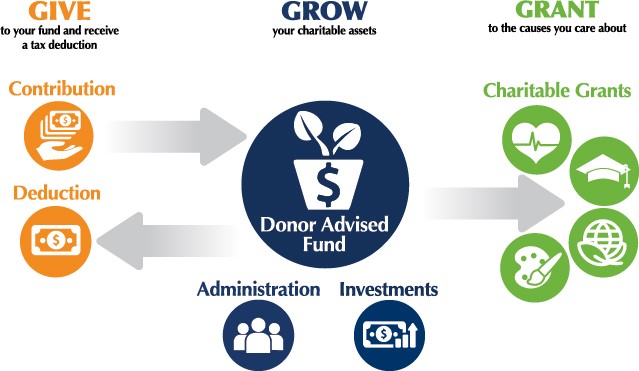

How Does DAF work?

There are four main steps that one needs to follow to get an overview of the DAF process. And they are

- The very first step to carry out the DAF process is to create an account for the same. After which, the individual or group who created the account can deposit the cash or marketable securities or assets into the fund. Here the assets are expected to grow over time.

- After depositing the assets, the donor can avail of the maximum tax deduction allowed by the IRS. They also lose all the legal rights over the assets after doing so.

- The legal rights over the assets are transferred to the sponsoring organizations. They offer advice on grantmaking.

- Since the donor holds the right to advise his funds, they choose the one they are willing to invest in after the sponsors make an offer.

This helps the donors hold the right over their funds and helps them avail themselves of significant tax benefits.

Types of Sponsoring Organizations That Manage DAF Fund

Three basic types of sponsors can manage a DAF fund. Take a look at them.

- Community foundations

Community foundation sponsors provide a strong understanding of local philanthropy. They even offer additional aids, such as family philanthropic consulting.

- Single issue charities

Single issue charities usually work in a specific sub-sector, such as a particular religion. This is why they encourage giving to a particular cause or organization.

- Commercial fund providers or national charities

These sponsors are either directly connected to the independent providers of DAF or national financial institutions. It’s a fact that despite being the newest type of donor, they sponsor around 40% of all donor-advised accounts.

Conclusion

DAF funds are charitable giving vehicles that help donors channel their sponsorships and help them achieve their philanthropic goals. These funds help them obtain their goals and bring them some additional tax benefits. So, it’s crucial to know in-depth about this entire strategy before investing in the same.

Authors Bio

Shrey Jain is the Co-founder of Writofy and a Chartered Accountant who holds a forte in creating informative content on niches like crypto, business, fintech, digital marketing, and several others. He is also a contributor on Hackernoon. In addition, his willingness to learn and share his knowledge can immensely help readers get valuable insights on varied topics.

Read More Articles.