If you are looking to start investing in commodities like precious metals, you might not be sure about where to get started. That is understandable considering what has been going on in the world. There is a lot of uncertainty regarding economics and finances.

The downturn that has occurred due to the COVID-19 pandemic has impacted a lot of us. It has certainly made me realize that I need a better cushion to protect myself during times of crisis. Having something like an account with a commodity or other alternative asset can be one way to do this.

If you are feeling uncertain or do not know how to get started, keep reading. I will guide you on what commodities are, why to invest in them, and how they can help protect against inflation of paper currency as well!

The Art of Commodities

When we hear the word, we might think of luxury goods or things we do not really need but do want. However, in the world of economics, that is not the definition. Rather, they are everyday goods. You can explore their world of them more here: https://www.coins.aaec.vt.edu/what-are-commodities/.

A classic example of them is in agriculture and farming. This includes both livestock and crops. For livestock, you might trade cows, pigs, or chickens. Of course, there are other options too like ducks.

The crops also vary. Some of the edible ones are cacao beans or bananas. Wheat, tomatoes, corn – really, any of the fruits or vegetables that we eat in a day. Non-edibles might be something like tobacco or cotton. They tend to come from big farms.

Something else you could get into with commodities is energy. What I mean by this is energy production or mining. Some of the most popular forms of power are from fossil fuels like oil or coal. However, as many parts of the world try to go more environmentally friendly, alternatives have been made.

One of the first types I think of is wind power. If you see large turbines near you, it is probably someone harvesting this. There is also waterpower, geothermal, and solar energy as well.

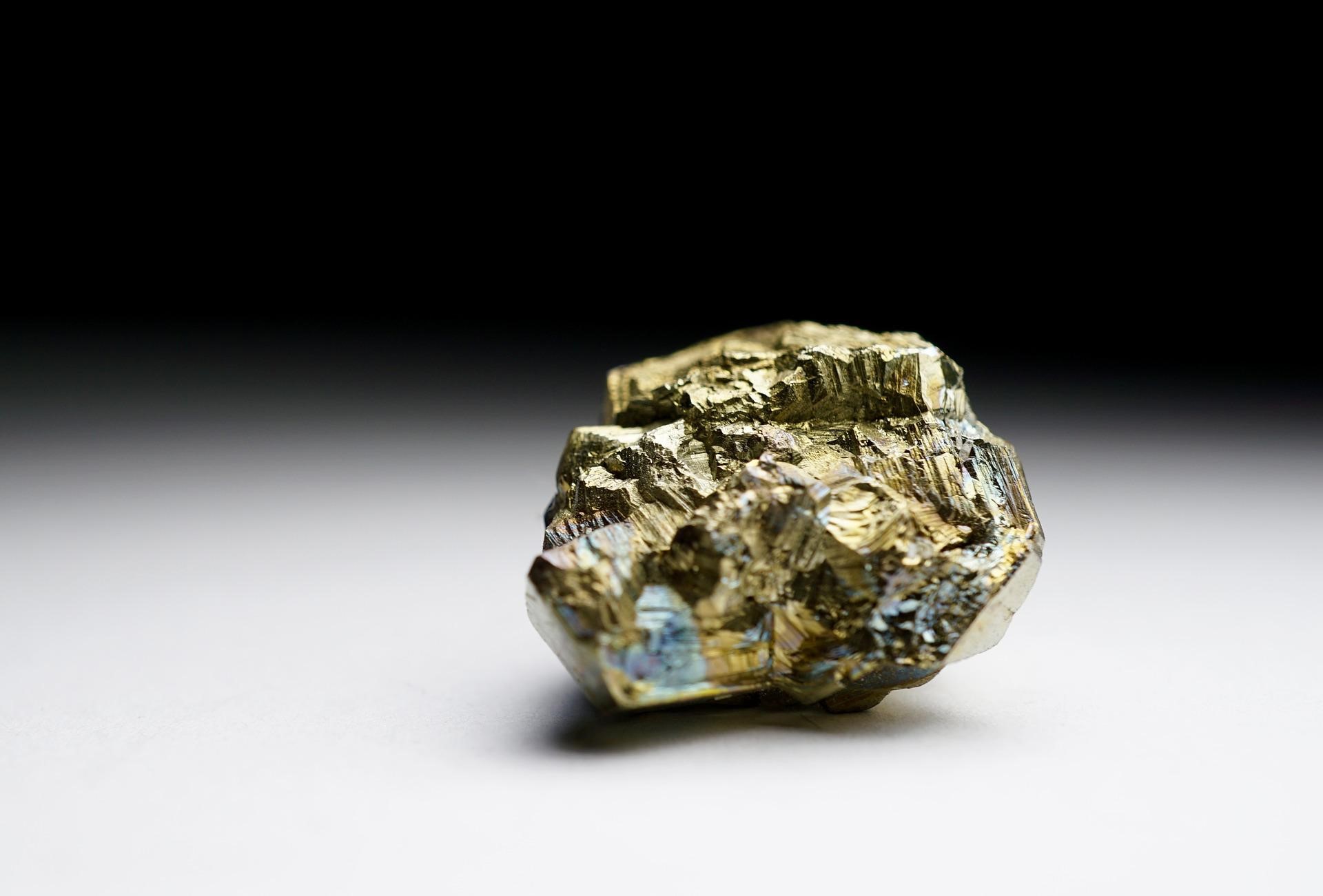

The final type I will discuss today are precious metals. Some that fall into this category are palladium and platinum, but silver and gold are what most people think of when I say the phrase. The former two are both silverish-white. They are often used in the manufacturing of vehicles, specifically in engines.

Gold is yellow, of course, and shiny. It has low reactivity, and it is malleable, hence its use in many things like jewelry and coins. Silver is gray in color and easy to mold into other shapes but has higher conductivity.

Know Why Gold Investment is Profitable?

Why Should You Invest?

As you can probably expect, there are a few reasons you could want to get into a market like commodities. The first is probably for your investment portfolio. If you have ever heard the phrase “don’t put all of your eggs in one basket,” it is applicable here.

Adding some variety to your assets is a big perk. You can learn more about how this works on this page. While the markets for them are volatile due to the nature of global trade and politics, they still can reduce the overall volatility of your folder. This is because of the returns from them.

Something else that is nice is that the prices of these goods often rise alongside inflation. So, they can give you a cushion against said inflation. They can defend you against the problems that come with overall rising prices.

Finally, the fact that they often come in a physical form is a benefit, so long as you have the storage space. Do make sure you can store them before you buy, especially with something like precious metals. However, if you do, sometimes they can hold value and if demand goes up, you can sell for elevated prices.

How to Invest

What most people do with these alternative types of assets such as commodities or real estate is put them into a self-directed IRA account. A traditional individual retirement arrangement does not allow for them, hence the self-directed part.

If you are looking to go with a physical item, you might want to check out a website like this one, https://investingingold.com/united-gold-direct-llc-review/, as a group like that can guide you on where to purchase. This is something you may want to do, as an IRA only allows a certain grade of precious metal to be deposited.

You will probably want to read up on all those guidelines and consult with professionals as you get started. This goes for the other methods of getting into this market as well. Another way is through futures contracts.

This is, of course, different than physical ownership. Essentially, you sign a contract with a company and buy the metal at one price, then receive the product later. This can be beneficial to the buyer if the price is low when you first purchase. However, if the prices of that metal dip in the long term, it is a bit of a risk.

You could also try individual securities or stacks. If you invest in the companies that work with commodities, it gives you some indirect access to the market. This means that if the price of the goods goes up, you will see higher returns for your folder. It is a good way to passively earn income.

If what you have read has incensed you to give it a try, I say go for it. Even a small holding of gold or silver bullion can pay off in the future. While you cannot put something like collectibles in an IRA account, you could put some of your coins in there depending on where they are from.

Once you start to learn the terminology and get more economic know-how, you will be on your feet in no time. Take your future into your own hands and try investing in commodities today! Just be careful and watch those prices!