KYC Verification Programs

The know your customer or know your client (KYC) rules in monetary services require that experts make an effort to confirm the identity, suitability, and risks included with maintaining a commerce relationship. Companies of all sizes also utilise KYC forms to guarantee their proposed clients, specialist, experts, or wholesalers are anti-bribery

compliant and are who they claim to be. Banks, Insurers, Trade Creditors, and

other financial institutions are now consistently requiring that customers give

detailed due diligence information. kyc providers help businesses and individuals ensure that customers’ activity is legitimate, and no identity fraud or money laundering

occurs.

Customer Identification Program

The Client Identification Program aims to enable the bank to make a sensible belief that it knows each client’s genuine identity. Identifying data obtained from each client. Moreover, it should include reliable and practical risk-based methods for confirming the identity of each client. Financial institutions should always make sure to take a risk evaluation of their client base and recent offerings, and in determining the risks they should consider:

- The bank’s account types.

- The bank’s account opening methods.

- The different methods for finding available data.

- The bank’s position, size, and client base, as well as the products and services that customers use.

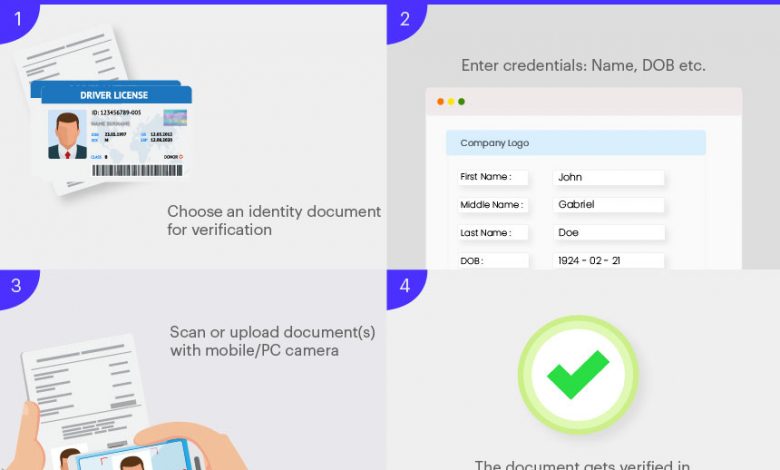

Before opening an account, a financial institution may ask for details such as your legal name, birthdate, address, and ID number.

While collecting this information provided, it is sufficient to verify the account holder’s identity at the time of account opening; however, the institution must do so “within a reasonable timeframe.” Such approaches for confirming your identity are as follows:

- non-documentary approaches (comparing the client’s data with the support of customer reporting programs, open databases, and other types of due diligence procedures, for example).

- A Combination of the two.

Customer Investigative Reporting

Customer investigative reporting identifies the clients and ensures that they are who they claim to be. In essence, this involves obtaining a customer’s identity, a photograph on a public record verifying their identity, as well as their private address and date of birth. Customer risk assessment is divided into three levels: simple, streamlined, and

enhanced.

Simplified Investigative Reporting

TIR may be connected when a risk evaluation has shown an insignificant or low chance of money laundering. The only thing that needs to be done is recognising the customer, and there’s no need to confirm the customer’s identity.

Basic Customer Investigative Reporting

It may be attributed to a risk assessment that showed a negligible or low risk of

financial fraud. The only thing left to do is identify the customer; there’s no need

to double-check its identity.

Enhanced Investigative Reporting

Enhanced Due Diligence refers to the collection of additional data for higher-risk clients to supply a more profound understanding of client action to reduce the risks associated with it. Finally, while a few EDD variables are especially revered in a country’s legislation, it is up to financial institutions to assess the risk and take necessary steps to ensure that they are genuine clients rather than bad actors.

Ongoing Monitoring

It is not enough to audit your client once; you must have a system in place that continuously screens your client. The continuous monitoring role involves keeping track of monetary transactions and accounts based on the customer’s risk limits. It is also something that businesses and individuals consider for sustainability and consistency that kyc providers usually offer.