Keeping your business running smoothly takes money. And with a business that sells beauty products, you’re going to need more than just a few dollars to keep things humming along. Whether you run a nail shop, hair spa, or any other service-based salon. Buying beauty products for your operation can be expensive. However, that isn’t an excuse to stay cash-strapped. There are various trustworthy alternatives to obtain a loan for your business’s purchase of fresh beauty items without significantly impacting your bank account. Here’s how you can do it.

Advantages of a Small Business Loan for Your Beauty Salon Product

When you’re looking for ways for getting a loan for your beauty product buys. You want to consider the advantages first. One of the biggest is flexibility. You can obtain a loan for your beauty product purchases in a number of ways, including via a bank loan, a corporate loan, or through a debt broker. You don’t even have to live in the same state as your customers or vendors. This lets you get product, pay your bills, and have some extra cash in your pockets while maintaining a remote business. Another advantage of a loan for buying beauty products is that it lets you take advantage of special financing offers. Lots of loan providers offer special financing programs. Which let them offer reduced rates and longer repayment periods for customers. Who are willing to sign up for long-term financing. You can also take advantage of such programs by providing your loan provider with a commitment to buy a certain number of products from them.

Printing Custom Hang Tab Packaging Boxes for Beauty Products

Five Important Things to Consider Before Getting Personal Loan

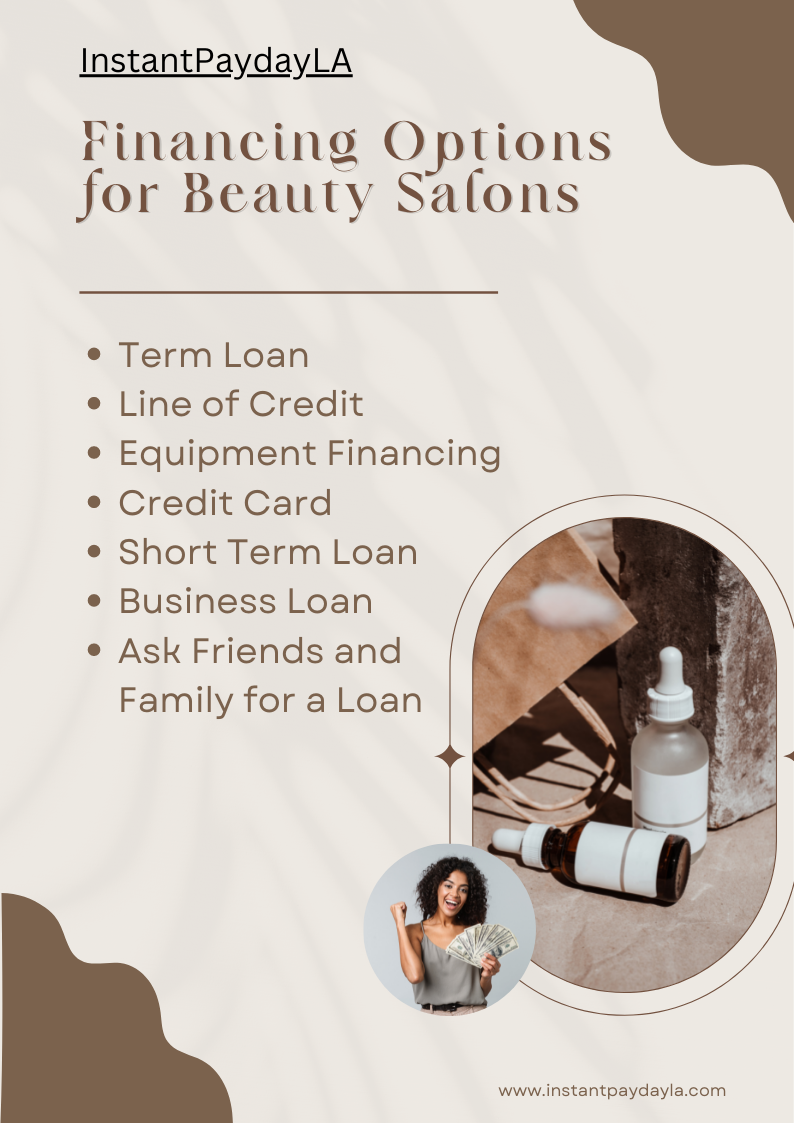

Financing Options for Beauty Salons

Despite the particular challenges of running a beauty business. There are definitely ways for getting a loan for your beauty product purchases. Beauty business loans are offered by a number of different sources, including banks, venture capital firms, debt brokers, and credit unions. Regardless of where you get your loan, you need to be aware of the laws in your state. While some states allow for general loans for beauty businesses, others only allow for loans. That serve a special purpose, such as funding an expansion. You’ll also want to make sure that the terms of the loan allow for you to repay it on time. If you don’t repay it on time, the bank or other lender will likely not only call you on the loan. But also sue you to collect on the money you owe. Read the following, loans can be utilized to launch, buy, or grow a salon business.

Term Loan

If you don’t want to take on the risk of a general business loan for your beauty salon product purchases, you can always consider a term loan. In this type of financing, you agree to pay the lender a certain amount of money, plus an agreed-upon amount of interest. The term loan comes with a set end date, meaning that you’ll need to repay it regardless of how well your business does over the term. That way, you can get a term loan for your beauty product purchases without the risk of not being able to repay your loan.

Line of Credit

Although a term loan has a set end date, you can also consider a line of credit. In this type of loan, you have access to a loan amount that’s set at the time of approval. If you have enough sales to repay the amount borrowed, you have the ability to repay the outstanding balance if you can get the money from the lender. However, if you don’t repay the loan, the lender has the right to take some of your sales as collateral. This way, you have the flexibility of a line of credit for your beauty product purchases without the risk of not being able to repay the loan, and without having to make a lot of sales.

Equipment Financing

Another way for getting a loan for your beauty product purchases is to finance your equipment purchases. In this type of loan, a lender approves a loan to pay for the cost of new machinery, as long as you agree to pay back a certain amount of interest on the loan. This is a good option for businesses that have a lot of expenses, such as a large payroll and high rent, as the interest on the loan can help pay for those costs. However, you’ll need to make sure the lender approves financing for your equipment, so you can’t simply buy it off the internet and expect the lender to write the check.

Credit Card

A credit card is a quick and easy way for getting a loan for your beauty product purchase. The best part is that you don’t have to give up any equity in your business to sign up for a credit card. You can get a card with a low interest rate and some credit limit, Then use the card to get an unsecured loan for your beauty product purchases. Keep in mind that credit card debt can wreak havoc on your finances, and can lead to bankruptcy if you don’t pay it off. If you don’t have the cash to pay off your credit card balance. You may wind up paying more in interest than if you had taken out a loan.

Short Term Loan

Finally, you can always get a short term loan. This type of financing is usually set at a set interest rate and given as a one-time payment. That way, you don’t have to worry about making interest-only payments on your no credit check loans online instant approval. Can focus on paying the loan off as soon as possible. You can use a short term loan for your beauty product purchases to bridge the gap between when you have the cash to buy inventory. When you can pay the vendors for their products. Short term loans can also be helpful if you get stuck in a cash crunch. For example, you can take out a small loan to pay for groceries or fuel to get you through until you get paid. However, you need to be careful to make sure that you can repay the loan quickly and without becoming delinquent on it.

Business Loan

Finally, you can always consider a business loan. In this type of loan, a bank or other lender provides you with a short-term loan. To help you buy new equipment or pay off existing debt, such as a business loan or credit card bill. You should keep in mind that business loans usually have a much higher risk of failure than other types of loans. You’ll need to be prepared to show that your business will generate enough cash flow to repay the loan. As you can see, there are a number of ways for getting a loan for your beauty product purchases. The best way to choose depends on your specific needs and preferences.

Ask Friends and Family for a Loan

If you don’t want to take on any of the risks of a loan for your beauty product purchases. You can always ask your friends and family for a loan. This is an informal type of lending, and you’ll likely be asked to provide little or no documentation to support your request for the loan. However, depending on your relationship with your friend or family member, you may still be able to get the loan. Even if you don’t have any clear documentation. They may be willing to give you a small amount of money. They may simply agree to help you out. Be careful to make sure you don’t overstay your welcome if they give you a loan. As you don’t want to go into the red on their dime.

How to Avail a Personal Loan in Four Easy Ways

5 Ways In Which Loan For Used Car Make Your Life Easier

How to Obtain a Loan for a Beauty Salon Product

While there are many ways for getting a 500 payday loan for your beauty product purchases. The best way to choose depends on your specific needs and preferences. If you want to, you can try different loan programs and see which one works best for you. However, you can start by researching the different types of loans available to see which one might be best for you. While certain loan programs are better for firms with short-term needs, others are better for those with long-term requirements. Once you’ve identified the type of loan that’s best for your situation, you can start applying for loans. Before you go to the loan provider, though, you should do some research to make sure you can repay the loan. And what you’d be getting for the loan.